Global Mezcal Market to Reach $1.6 Billion by 2030

26.02.2024

3 min read

Research and Markets

Fuel your strategic decision-making with deep and reliable insights into the global Mezcal market - a dynamic industry projected to reach a substantial value of US$1.6 billion by 2030.

The Volcanic Advantage: Why This Soil Type Is Every Farmer's Dream

07.02.2024

Erik Miller (Farmfolio)

To most people, dirt is just dirt. But the fact is that there are huge differences in soil quality depending on type. Learn why volcanic soil is so much more valuable than regular soil. It’s easy to think all soil is the same. After all, dirt is dirt, right?

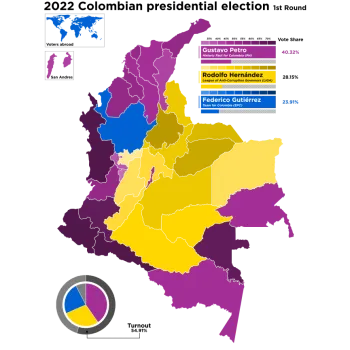

Why Colombia Is a Top Foreign Investment Destination For 2024

24.01.2024

Erik Miller (Farmfolio)

Due to economic, political, and natural factors, Colombia remains among the best FDI destination on Earth in 2024.

2024 could be Colombia's year.

After the pandemic derailed Colombia’s promising 2020, which was on track to break records in terms of tourism, foreign investment, and exports, the country made a swift recovery, adding back millions of jobs and regaining much of its export volume.

Now, the country is in better shape than ever, and is looking forward to record FDI inflows that will stimulate growth and make Colombia an economic powerhouse - especially in terms of agriculture.

Here are a few key reasons why Colombia is one of the best targets for foreign investment on the planet as we enter 2024.

Why Commodities Will Be This Cycle’s Big Winner - How You Can Benefit

13.12.2023

Erik Miller (Farmfolio)

As expected, commodity prices have increased massively following inflationary pressures worldwide. But this is no ordinary cycle.

It’s a well-known fact that commodities excel during inflationary periods, and the current cycle has proven to be no exception. The price of consumer staples has skyrocketed in recent years, leaving consumers feeling the pain at supermarket shelves and in many other aspects of their economic lives.

But this effect isn’t just felt by consumers - prices are also high in the mining and energy sectors. For instance, gold is now just 2% away from its all-time high, and the cost of gasoline has been an ever-present topic of conversation in recent years. Production costs have also accelerated across other economic sectors.

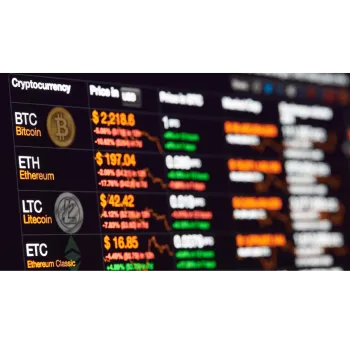

Navigating the Cryptoverse: Insights and Outlook for 2024

06.12.2023

Robinson Kingsley

In the ever-evolving crypto market, the past year has seen its share of transformations, sparking debates about the waning allure of the crypto buzz. However, Robinson Kingsley (RKI) has delved deep into the highs and lows of the crypto journey, identifying significant opportunities still on the horizon. This week's Insight reflects our exploration of expert opinions, industry insights, and the dynamic trends shaping the crypto landscape.

Clean Energy's Role in Driving Development in Emerging Markets

27.11.2023

Robinson Kingsley

As the world grapples with the dual challenges of climate change and burgeoning energy needs, Robinson Kingsley sees emerging economies as being uniquely positioned to leapfrog traditional development pathways by embracing clean energy solutions.

Clean energy, comprising renewable sources like solar, wind, and hydroelectric power, not only mitigates environmental impact for emerging economies, but also holds the key to unlocking sustainable and inclusive development. Our Insight feature this week, explores how the adoption of clean energy can drive progress, delving into both the challenges and opportunities that lie ahead.

Unlocking Opportunities: How Progressive Entrepreneurs Can Leverage AI

20.11.2023

Jeevan Robinson

In the dynamic landscape of business, progressive entrepreneurs are always on the lookout for innovative ways to stay ahead of the curve. At Robinson Kingsley, we believe that Artificial Intelligence (AI) presents a transformative toolkit that, when harnessed effectively, can open up a myriad of opportunities for forward-thinking business leaders. RKI presents some Insight on the ways progressive entrepreneurs can utilize AI to create new and exciting possibilities:

BRICS: The Disruptive Force Set To Shake the Global Order

11.11.2023

Jeevan Robinson

RKI's analysis of BRICS: Is this the new global disruptive force?