Why Commodities Will Be This Cycle’s Big Winner - How You Can Benefit

By:

Erik Miller (Farmfolio)

On

13/12/2023Reading time:

7 min

Summary:

As expected, commodity prices have increased massively following inflationary pressures worldwide. But this is no ordinary cycle.

It’s a well-known fact that commodities excel during inflationary periods, and the current cycle has proven to be no exception. The price of consumer staples has skyrocketed in recent years, leaving consumers feeling the pain at supermarket shelves and in many other aspects of their economic lives.

But this effect isn’t just felt by consumers - prices are also high in the mining and energy sectors. For instance, gold is now just 2% away from its all-time high, and the cost of gasoline has been an ever-present topic of conversation in recent years. Production costs have also accelerated across other economic sectors.

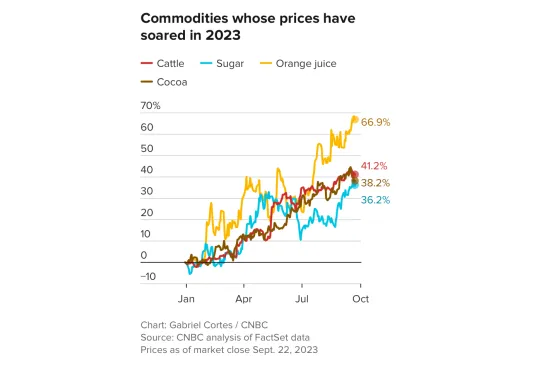

Major commodity price increases, YTD (Source: CNBC)

It’s worth considering why these price increases are occurring at this particular moment. Yes, persistent logistical constraints and geopolitical conflicts are driving up the prices of goods and services.

But when price increases occur in all sectors for an extended period, it’s an indicator of the widespread loss of a currency's value. It’s not that things are more expensive - it’s that the money that people use to pay for them is worth less.

On the face of it, this is somewhat of an obvious line of thinking. However, inflation is just one side of this story. Violent conflict, reckless money-printing, and persistent logistical constraints have swelled together to create a perfect storm for a commodities.

Are We On The Cusp Of A Commodities Super-Cycle?

A commodities super-cycle is commonly defined as a sustained period of significant price increases in the commodities sector. As such, it’s difficult to say if the movement we’ve observed will constitute a cycle or not.

Some say no, we’re not entering a super-cycle, pointing to the recent shocks and black swan events that have left the economy reeling. The argument is that the price increases triggered by these events don’t constitute a super-cycle because they are external and not the product of the natural evolution of the market.

But whether or not the phrase ‘super-cycle’ is technically accurate is beside the point. The reality is that commodity prices are up - way up - relative to asset values, earnings, or basically any other metric.

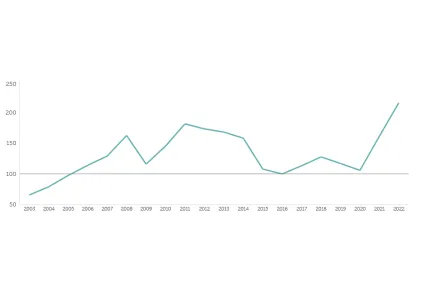

The IMF All Commodity Price Index reached a new historical high in 2022.

So what does this mean? What signals can we take away from this? Simple.

The recent spike in commodity prices is a not-so-gentle reminder that the basis of the modern economy - or any economy, really - is production. It’s not trading or lending or borrowing or even investing. The economy works because someone, somewhere, produces goods or services that people want to pay for.

For some, this reminder will be especially harsh. In recent years - and especially following the massive injection of liquidity into markets following the pandemic - speculation and fanciful investing strategies have run rampant, as evidenced by the recent NFT crash.

The surge in commodities and commodity-based investments will push the public back towards conventional de-risking strategies and productive assets, challenging many of the commonly-held notions that have arisen during the post-2008 era.

De-Risking and the Importance of Productive Assets

Although the prevailing consensus among analysts and policy-makers suggests that the Western countries are moving towards more service-based economies with a decreased focus on industry and the primary sector, the reality is quite different.

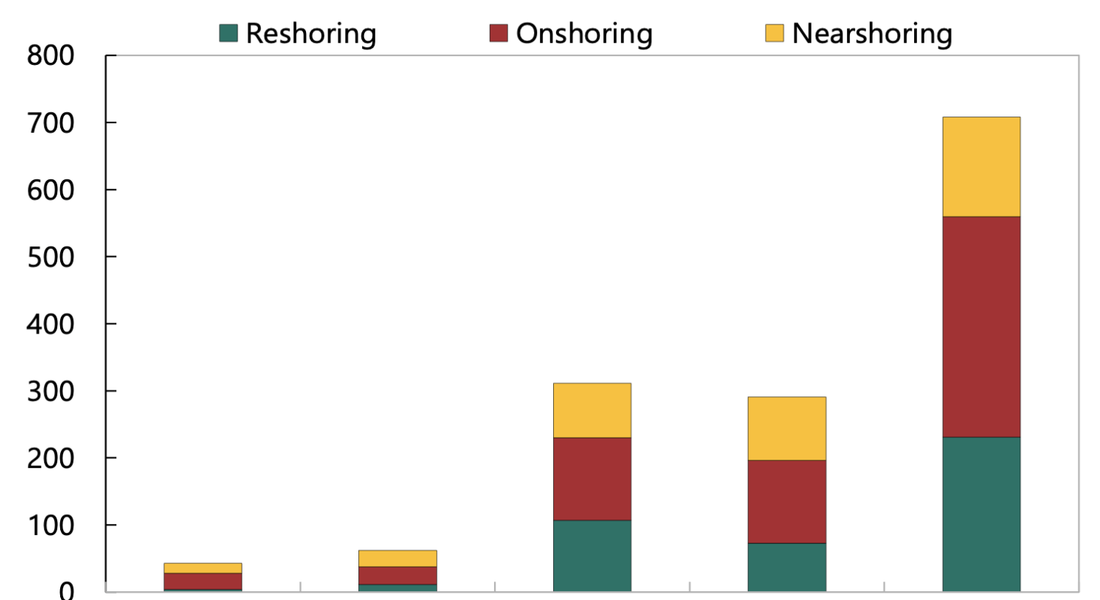

Current global conflicts and disruptions in supply chains have forced Western countries to reevaluate their supply chains, aiming to decrease their dependency on foreign powers. This often involves reshoring, or moving production to geographically closer regions with stronger diplomatic ties.

An example of this can be seen in the ongoing efforts to 'decouple' U.S. supply chains from China, which has led to a growing trade relationship with Mexico and other emerging nations, as discussed in previous articles.

Growth of reshoring, onshoring, and nearshoring (Source: IMF)

One of the strategies the United States is currently pursuing involves nearshoring activities to countries with lower operating costs. Mexico, for instance, plays a significant role in auto parts production, and other countries in the Americas are experiencing increased investment inflows as part of the ongoing effort to complete the 'nearshoring' of supply chains. Agriculture has also been a major focus of this effort.

In the post-Cold War world, when the United States was the sole hegemon, it made sense to maintain a risk-on attitude regarding the outsourcing of industrial and primary production.

However, we are currently heading towards a scenario of economic geo-fragmentation where self-sufficiency is more valued, a world where commodities - and the companies that produce them - are essential for the development of more independent economies. It’s worth noting that both major U.S. political parties seem to subscribe to this hypothesis.

This leads us to ask: who benefits in a world where fiat currencies show weakness, major powers are shifting towards nearshoring, and commodities are increasing in relative value?

Gaining Real Exposure To Commodities

There is no shortage of ways to gain exposure to commodities, and many of them have a reasonable place in a diversified portfolio. Precious metals, commodities ETF’s, and stock in companies that produce commodities could all be viable options for investors looking to gain exposure.

But there’s one avenue to exposure that uniquely benefits from both the growing phenomenon of nearshoring and the relative increase in commodity prices - farmland in emerging markets.

Farmland in emerging markets, such as the opportunities Farmfolio offers to its network, can have a higher ceiling for appreciation because of their newfound connections to global the global economy. They can also benefit from commodity price increases by exporting their goods to the developed world.

For many, finding a silver lining in today’s darkening economic environment is proving increasingly difficult. But it’s not altogether impossible. One upside is the increase in commodity prices and the benefits offered to those who own assets that can produce valuable commodities.

If you’d like to add assets of this kind to your portfolio, don’t hesitate to get in touch. We can help you add productive farmland to your portfolio to generate passive income and realize long-term appreciation.

Get in touch today to learn more about these incredible farmland opportunities.

Subscribe to our newsletter

Subscribe to our newsletter and be at the front of everything.